On 27 October the Chancellor Rishi Sunak unveiled the Government’s Autumn 2021 budget, which saw a big change to alcohol duties: from 2023 alcohol will be taxed based on its strength, so the stronger the alcohol the higher the tax.

However, as many have said, the devil is in the detail.

So what is the detail?

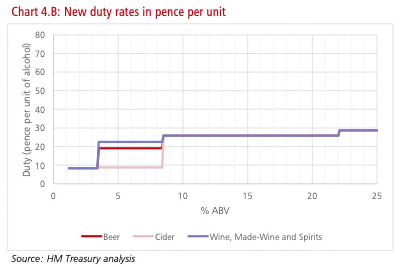

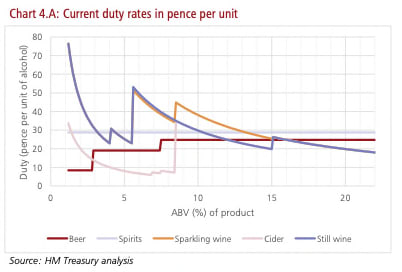

Our current alcohol duty system is full of inconsistencies whereby different drinks are taxed at different rates according to both strength and volume. An overview of the current system is presented in chart 4A, which is taken from the Government’s Alcohol Duty Review consultation document. The new system proposed by the Chancellor will simplify the alcohol duty structures by reducing the number of strength ‘bands’, or Alcohol by Volume (ABV) ranges to apply duty rates to. These bands will be applied more consistently across alcohol product categories and are presented in chart 4B.

The alcohol content bands that duties will now be applied to are: 1.2-3.4% ABV, 3.5-8.4% ABV, 8.5-22% ABV, and above 22% ABV.

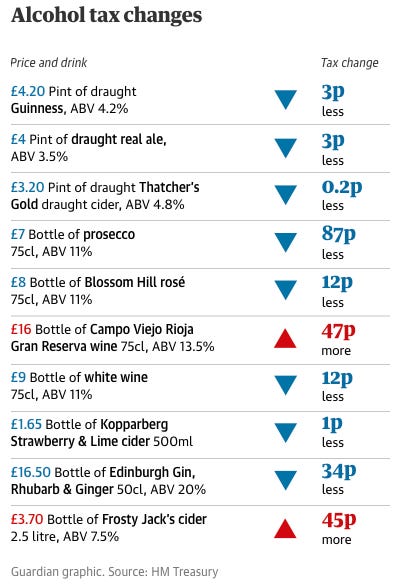

For the bands 8.5-22% ABV and above 22% ABV, all products across all categories will pay the same rate of duty. The duty applied to a bottle of rose wine, for instance, will come down by 23p per bottle while strong beer will attract more duty. Here’s an example from The Guardian of how some drinks will change in price.

Draught beer duties will be reduced by 5% for containers over 40 litres, in an attempt to support the hospitality industry. The Campaign for Real Ale (CAMRA) said:

“The introduction of a draught duty rate is a game-changer for cask beer drinkers, cider and perry drinkers and the great British local. This is something CAMRA has campaigned on for many years and we are delighted the Government has listened”.

However the Society for Independent Brewers (SIBA) said it had called for the draught beer duty relief to apply to containers above 20 litres – so that it would benefit craft keg and cask. As the policy only applies to 40 litre containers, bigger companies will benefit more.

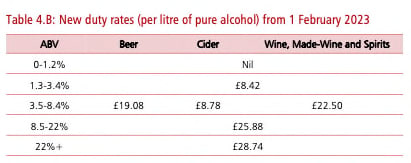

One of the less rational aspects of the changes is the continuation of lower duty rates for cider. Under the new proposals, cider will attract less duty than other products of the same strength, until it reaches the higher band of >8.5%. As table 4B below shows, cider duties will be less than half of beer duties for the same strength products.

The Government reasoning for this is that they are “mindful of the significant impact this would likely have on the cider industry. Apple and pear cider clearances have been in decline for the last decade, with volumes decreasing 28% since between 2009 and 2019”.

In response to this, health economist Colin Angus, of the University of Sheffield, said:

“All this does is encourages heavier drinkers to drink cider. Because it’s much cheaper. And they do. The Treasury acknowledges the issue, but protests they can’t fix the huge disparity, because it would involve there then not being a huge disparity… This is by far the biggest failing of the UK duty system and until somebody fixes it and taxes cider on a par with beer, heavy drinkers are going to continue to do themselves a huge amount of harm drinking incredibly cheap white cider.”

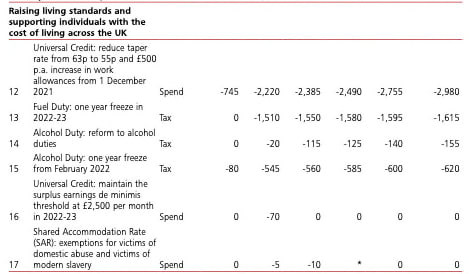

Another announcement at the Budget that sparked concern amongst public health bodies was the freezing of alcohol duties once more this year. As the Treasury’s own figures show below, this will cost the UK Government over £0.5billion every year, as well as increasing harm, which the increase in affordability inevitably leads to.

In response to the changes, IAS Chief Executive Dr Katherine Severi said:

“We welcome the principles outlined in the Chancellor’s alcohol duties review to protect public health and simplify the system by tackling high-strength low-cost alcohol. It is common sense that stronger drinks should cost more, as they do more damage to the health of individuals, to families, and to wider society.

Alcohol harms have been felt more acutely during the pandemic, with alcohol-related deaths increasing 20% in 2020. Unfortunately, today’s freeze on all duties over the next year will do nothing to alleviate these harms in the short-term, which represents a missed opportunity to achieve the public health goals set out by the Chancellor today.

This means the new duty structures will need to work harder to improve public health and tackle inequalities across the UK. We will continue to work with government to push for changes to alcohol duty that result in meaningful health gains and reduce the cost of alcohol to society.”

Professor Sir Ian Gilmore, of the Alcohol Health Alliance, said:

“The decision to once again freeze alcohol duty is totally misguided. We are already at crisis point when it comes to alcohol harm. Deaths caused by alcohol reached record highs in 2020 and making alcohol even cheaper will only deepen the health inequalities that this government had promised to address.”

In terms of next steps, the Government has launched a consultation on the duty changes, the deadline for which is 30 January 2022.