The Chancellor of the Exchequer announced cuts to alcohol duties in today’s annual Budget. George Osborne MP announced that the price of beer duty would be cut by 1p on a pint, and that duties on cider, Scotch whisky and other spirits would be cut by 2%. Wine duties are to be frozen.

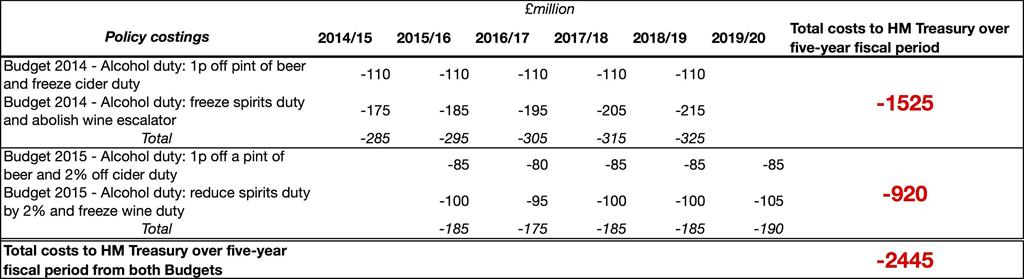

The Treasury has estimated that these cuts would cost £920m in revenue over the course of the next five years (illustrated). This is in addition to the £1.5 billion cost of scrapping the alcohol duty escalator in last year’s Budget, bringing the total cost to the public purse for alcohol duty cuts to £2.4 billion over the next five years.

Source: HM Treasury, Budget 2015 policy costings, p.64; Budget 2014 policy costings

Public health campaigners have criticised his statement for failing to address the health impacts of cheaper alcohol. They argue that alcohol tax cuts in the last two years’ budgets would pay for (over the next five years):

- The annual salaries of 12,389 nurses

- Nearly 10.5 million emergency ambulance calls over the next 5 years or over 2 million a year

- Over 10 million hospital bed days

Katherine Brown, Director of the Institute of Alcohol Studies, said:

“To cut tax on cider and spirits at a time when the NHS is at breaking point is a total disgrace. Our frontline services simply can’t afford for cheap drink to get cheaper.

“Police, doctors, nurses and paramedics up and down the country have to deal with the results of a flooded cheap drinks market every day. Yet their voices and calls for support have been totally ignored.

“This government’s failure to keep its promise to come down hard on cheap alcohol has let everybody down except the drinks industry. It’s let the NHS down, the police down, but most of all it lets every taxpayer down. We are all footing the £21 billion bill of alcohol harm to our economy each year.”