In this month’s alert

Public Health Scotland recommends continuation of minimum unit pricing policy – podcast feature

Public Health Scotland has released its final report on the minimum unit pricing policy, which it says “has had a positive impact on health outcomes”.

Their Director of Public Health Science, Dr Nick Phin, concluded that:

“Public Health Scotland is confident that MUP is an effective mechanism to reduce alcohol-related harm in Scotland and we support the continuation of MUP beyond April 2024.”

The report summarises the available evidence collected over the past five years since the policy was introduced in May 2018 and states that:

- MUP led to a 3% reduction in alcohol consumption at a population level.

- The reduction was particularly driven by sales of cider and spirits through the off-trade (supermarkets and shops) products that increased the most in price.

- The greatest reductions were amongst those households purchasing the most alcohol, with little impact on households purchasing at lower levels.

- It has reduced deaths directly caused by alcohol consumption by an estimated 13.4% and hospital admissions by 4.1%.

- The largest reductions in deaths were seen in men and those living in the 40% most deprived areas.

- For those people with alcohol dependence there was limited evidence of any reduction in consumption and there is some evidence of consequences for those with established alcohol dependence on low incomes, that led them to prioritise spending on alcohol over food.

- At a population level there is no clear evidence of substantial negative impacts on social harms such as alcohol-related crime or illicit drug use.

- Read Alcohol Focus Scotland’s briefing for more detail on the findings

The Institute of Alcohol Studies welcomed the news, with chief executive Dr Katherine Severi highlighting the lives saved:

Alison Douglas, chief executive of Alcohol Focus Scotland, called for the rate to be increased:

“Now we know that minimum unit pricing is truly life-saving, the policy must be continued, and the price increased. To scrap it now or leave it at a level that will quickly lose its effect would condemn hundreds of people to unnecessary suffering.

“Alcohol Focus Scotland and 29 charities and medical organisations have called on the Scottish Government to uprate the minimum unit price to at least 65p per unit. We hope the Parliament will come together again as it did in 2012, to optimise this policy, improve the nation’s health and reduce the burden on our NHS.”

On our podcast, Professor John Holmes (Director of the Sheffield Alcohol Research Group) said that there was a lot of support for the policy, particularly on the backbenchers, but that:

“There are challenges. It has had a difficult journey politically in the past. We should be cautious about how optimistic we are about action on minimum pricing in the UK parliament any time soon.”

First Minister Humza Yousaf tweeted that he was proud the Scottish Government committed to the policy.

The policy will expire on 30 April 2024 unless the Scottish Government votes later this year to continue it.

Interim analysis of Welsh MUP reveals mixed picture

A 24-month review of the introduction of minimum pricing for alcohol in Wales suggests a mixed picture so far.

It has successfully raised the price of a number of especially cheap products, most notably cheap ciders. This has led to a switching of products to strong lager, spirits or wine.

There was no obvious impact on consumption for most, in part due to many products not being affected at the 50p per unit level. Any potential effect of the minimum price may have been eroded by inflation and the rising cost-of-living.

The biggest confounding factor has of course been the COVID-19 pandemic. The policy was introduced in Wales on 02 March 2020, almost precisely when the pandemic began. The pandemic led to a polarisation of drinking across the UK, with moderate drinkers generally consuming the same or less, and heavier drinkers on average consuming at more harmful levels. This is partly why Wales, along with the rest of the UK, has seen an increase in alcohol-specific deaths over the past few years.

It is therefore incredibly difficult to understand the impact minimum pricing has had in Wales. Whereas in Scotland there were two pre-pandemic years where the policy was active, Wales does not have that comparison.

The Welsh review found some consistencies with the Scottish evaluation, for instance that many of the feared negative impacts have not materialised – such as increased crime or switching to illegal drug use – but also that some dependent drinkers have been adversely affected.

The report recommends an active review of the current 50p price level and reinforcing communications about who the policy is targeting.

New alcohol duty system provides an opportunity to fix inconsistent government messaging – podcast feature

The UK government has given a wide range of arguments for increasing or decreasing alcohol duty which have sometimes contradicted each other over the past 15 years, according to new research by the Institute of Alcohol Studies (IAS).

Each year, HM Treasury and Office for Budget Responsibility forecasts assume that alcohol duties will increase in line with inflation, so that they stay the same in real terms. At each Budget the Chancellor of the Exchequer announces whether duties are cut, frozen, or increased. They have mostly been frozen in recent years.

Increasing the price of alcohol is one of the most effective and cost-effective ways of reducing population level alcohol consumption and subsequent harm, and duty increases are a key mechanism to do this.

Thematic analysis by IAS looked at how HM Treasury and its ministers have communicated decisions on duty rates since 2008 and found that there has been a wide variety of messaging. The framing of these decisions has often contradicted previous announcements and been inconsistent with other departments’ public health aims.

The six over-arching themes identified were: Appealing to both continuity and change; Supporting industry and business, especially the Great British Pub; Contributing to public finances and improving tax structures; Benefitting consumers and families; Improving health and reducing alcohol harm; Advancing fairness and simplicity.

The themes identified suggest there are many apparent, and sometimes contradictory, objectives and little long-term strategy in public policy decisions on alcohol duty uprating. However, the reform of duty – which will commence on 1 August 2023 – does suggest a positive move towards clearer long-term goals for the system.

Over the past 15 years, stated objectives of alcohol duty often conflicted with other aspects of alcohol policy, highlighting a lack of policy coherence across government departments. For example, in 2016, revised low risk guidelines were introduced by the Department of Health and Social Care reflecting the latest evidence that there is no safe level of alcohol use, while the same year, beer, cider and spirits duties were frozen by HM Treasury, making alcohol more affordable.

In the announcements, different drink categories were given different amounts of attention, with beer and spirits duties being most prominent. Beer duty was often linked to pubs, pub patrons, and national identity. Announcements on spirits duty were often communicated as being about Scotch whisky, despite whisky not being the most consumed spirit, and the fact that almost all Scotch whisky is exported and therefore not subject to UK excise duty.

IAS recommends the introduction of an independent commission to set levels of alcohol duty and include an automatic uprating mechanism. This will help ensure duty keeps pace with inflation and doesn’t lose value in real terms. By making the system an automatic technical decision, rather than a political tool at each Budget, public health considerations will be more protected, one of the stated goals of the new duty system.

Does alcohol consumption lower stress and heart disease risk?

A new study in the Journal of the American College of Cardiology this month, suggested that light to moderate alcohol consumption is linked to reductions in the brain’s stress activity, and therefore may be associated with lower risk of heart disease.

The study started off with the assumption that moderate alcohol consumption is associated with reduced risk of heart disease – this premise has been increasingly questioned in recent years (see the section below for more detail: Better quality studies have improved our understanding).

The researchers assessed the effect that light to moderate drinking – which was categorised as 1-14 drinks a week – had on resting stress-related brain activity. For those who drank small amounts, the scans showed reduced stress signalling in the amygdala brain region, which is associated with stress response. Study author Dr Ahmed Tawakol said: “We found that the brain changes in light to moderate drinkers explained a significant portion of the protective cardiac effects”.

However, he added that:

“We are not advocating the use of alcohol to reduce the risk of heart attacks or strokes because of other concerning effects of alcohol on health. We wanted to understand how light to moderate drinking reduces cardiovascular disease, as demonstrated by multiple other studies.”

Professor Naveed Sattar, professor of metabolic medicine at the University of Glasgow criticised the methodology:

“The issue is we know any amount of alcohol is associated with strokes and heart failure, and with increases in cancer and deaths from cardiovascular causes. So to concentrate only on one small aspect, even if true, gives the wrong impression and the title of better heart health with light to moderate alcohol is misleading and perpetuates old myths we really need to move on from.”

Both Professor Petra Meier (University of Glasgow) and Dr Sadie Boniface (Institute of Alcohol Studies) pointed out that the study hadn’t taken all confounders into consideration, with Prof Meier stating:

“The study was able to include some of these factors but not comprehensively. For example, neither lifetime alcohol consumption history nor ethnicity were included.”

Dr Boniface added that:

“There are many health different effects of alcohol. In this study, higher rates of cancers were noted among moderate drinkers, and poorer cognitive health was also seen among people with higher levels of alcohol use. This fits with what we know from other studies.”

Journalist and writer Adrian Chiles – who has written about his previous heavy drinking and the health harms of alcohol – wrote in The Guardian:

“Another week, another article suggesting that alcohol may have health benefits. It’s amazing how desperate drinkers are to fool themselves.

“The problem is that there are drinkers and industry PRs and libertarian anti-“nanny state” culture warriors who will be dredging up this story to drop into conversations many years from now.”

Better quality studies have improved our understanding

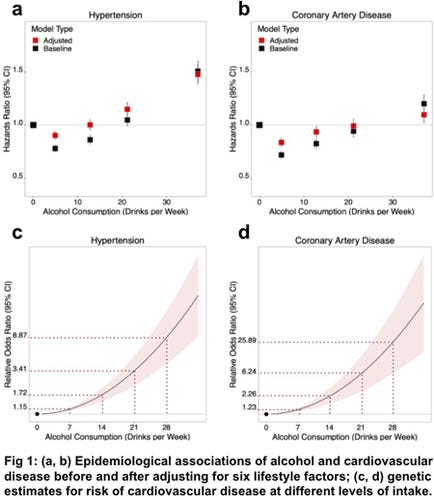

Many studies over the years have found a J-shaped relationship between alcohol consumption and the risk of heart disease. This suggests that those who drink moderate amounts of alcohol have a lower risk of heart disease than those who drink heavily, but also those who abstain. Studies with these findings have often highlighted that this could be due to confounding factors, for instance moderate drinkers being generally healthier than abstainers.

In recent years, better quality studies have disputed these findings, using a design method called mendelian randomization. There is an ethical barrier to running a randomised control trial (RCT) relating to alcohol consumption, which is why observational studies are used. However, mendelian randomization can somewhat replicate the design of an RCT as it uses genetic variance to examine causal effects of a modifiable exposure – in this case alcohol consumption – on disease in observational studies. And what these studies find is that there is no cardioprotective effect of alcohol.

For instance, in the journal Cardiology, a 2021 study concluded that “alcohol consumption at all levels was associated with increased risk of cardiovascular disease”, although the risk was quite low for moderate drinking, but rapidly increases with heavier drinking, as shown in the following figure.

Brewers and wine manufacturers reduce the ABV of products to save on duty

The Mail on Sunday reported that the strength of a number of beer products has been reduced by brewers to save money on duty.

The paper found that Foster’s has dropped from 4% earlier this year to 3.7%. Old Speckled Hen is down from 5% to 4.8%, Spitfire Amble Ale is down from 4.5% to 4.2%, and Bishops Finger is down from 5.4% to 5.2%.

With the alcohol duty reform being introduced from 01 August this year, a reduction of only a 0.5 percentage points would save millions in duty for the bigger brewers. In the article, health economist Colin Angus is quoted as saying that only a 0.3 percentage point reduction would collectively save around £250 million on duty payments to the government.

Although some of the companies who were interviewed explained that the measure was about reducing the amount they would need to pay in duty, others said that it was a public health measure.

Dr Sadie Boniface questioned this:

“It unlikely that public health is the main reason companies are reducing strength. Alcohol multinationals – like Heineken or Diageo – are first and foremost profit-driven companies that want to make money for their shareholders. They rely on harmful drinking for these profits, as the heaviest drinking 4% of the population account for 30% of all alcohol consumption in England. A small decrease in strength is unlikely to be noticeable to consumers, but could save millions of pounds of duty for the bigger producers, protecting profits during a time of rising production costs.”

Research director at the Social Market Foundation and IAS advisor, Dr Aveek Bhattacharya agreed:

“I think we should be a bit sceptical of brewers claims that is being driven by anything other than financial incentives.”

Discussing the reform, Dr Boniface welcomed the news that some brewers were reducing the strength of drinks:

“One of the aims of the reform was to encourage product innovation around lower strength products, which could improve both consumer choice and public health. Therefore it is positive to hear that many companies are already in the process of reducing the strength of some of their products.”

A week later, The Telegraph reported that a number of wine producers are also reducing the strength of some products in an attempt to reduce duty payments. However this was being framed as directly related to duty rates being increased in line with inflation from August (which will coincide with the reform).

The difference here compared to beer is that under the current system, wine duty is not based on the strength of the product, whereas for beer it is. When the reform comes in, for the first time there will a financial incentive for wine producers to reduce the strength of their drinks.

However, it is slightly more complicated, as – due to wine industry lobbying – once the reform comes in, there will be a transitional period where wine between 11.5-14.5% ABV will be taxed as if it is 12.5%. Therefore, during this period, there is only a financial incentive if strength is reduced below 11.5%.

In a thread explaining the story, Colin Angus writes:

“It’s also worth saying that this is precisely the aim of the new duty system. By linking how much duty is levied on a product with the amount of alcohol it contains there is a direct financial incentive for producers to lower the strength of their products.”

Twelve countries object to Ireland’s labelling laws at WTO meeting

At a World Trade Organization (WTO) meeting on 21 June, the United States, along with a number of other countries, expressed concern about Ireland’s plans to require health warnings and nutritional information on alcohol labels.

Countries that supported the complaints – including Japan, Australia, Canada, Chile and Colombia – argued that the measure would present a barrier to trade. The main objection was that exporters would have to produce labels specifically for the Irish market, and that this would create new costs and reduce the ability of businesses to move products within the European market.

However a representative for the EU on behalf of Ireland denied that businesses would have to provide custom labels, and that required labelling information can be placed on the alcohol products with a sticker after they are imported into Ireland.

WTO countries can continue to raise objections about Ireland’s law at the committee until their concerns are resolved. If concerns about barriers to trade are not satisfied, the process can lead to the opening of a formal trade dispute.

Health Minister Stephen Donnelly said he was “not concerned” with opposition from the twelve countries at the WTO meeting and that the Irish government was pressing ahead with the introduction of the new rules.

Australia’s alcohol strategy accused of being “watered down” by industry influence

A study analysing submissions to the development of Australia’s national alcohol strategy has found that alcohol industry submissions often presented peer-reviewed research in a one-sided way, selectively quoting or misrepresenting the evidence.

Of the twelve submissions from the alcohol industry, three asserted that drinking alcohol in moderation had health benefits; three argued that alcohol was not a causal factor for violence; and eight argued against a minimum unit price on alcohol and against strengthened pricing and taxation policies.

Adjunct Professor Terry Slevin, the CEO of the Public Health Association of Australia, said:

“I have no doubt that alcohol industry lobbying heavily influenced and watered down the National Alcohol Strategy.”

One submission stated that a multi-country study showed “the net effect of alcohol consumption was to reduce adverse health outcomes”. However, the study actually concluded drinking was “not associated with a net health benefit”.

The study authors say their research “demonstrates that the alcohol industry continue to manipulate, misuse and ignore evidence in attempts to influence policy.”

The federal health minister, Mark Butler, said the Australian strategy was developed with input from a wide range of stakeholders, and that:

“There is no suggestion the strategy was influenced by alcohol lobby groups. The Australian government supports the development of public health policy that is free from commercial and other vested interests as outlined in the National Preventive Health Strategy 2021-2030, and other key national public health strategies including the National Tobacco Strategy 2023-2030.”

UK government encourages local authorities to support children of alcohol dependent parents with Drug Strategy funding

The Department of Health and Social Care and Department for Work and Pensions published a press release on 01 June that encouraged local authorities to use funding from the Drug Strategy to support the children of alcohol dependent parents.

This follows news from earlier in the year that the government cut the £6 million package that supported these children, meaning there will be no dedicated funding and support.

In the government release, it states that the previous funding to support these children, which ended in March 2022, had a positive impact on the whole family unit including on parents accessing treatment.

The release is likely in response to calls from the charity Nacoa (National Association for Children of Alcoholics) and the Alcohol and Families Alliance for funding to be set aside specifically for these children.

Health Minister Neil O’Brien said:

“We owe it to these children to make sure support is available. This scheme has equipped local authorities with the tools they need to get people into treatment and on the road to recovery and this independent review clearly demonstrates the success of the scheme.

“I’d encourage local authorities right across England to use the funding we’ve provided [in the drug strategy] to adopt similar approaches and to get more people into treatment.”

Scotland delays deposit return scheme by two years

The Scottish government is delaying its deposit return scheme for more than two years after accusing UK government ministers of deliberately sabotaging its plans.

UK ministers rejected Humza Yousaf’s request for them to rethink their decision to exclude glass from the scheme.

England, Wales and Northern Ireland originally consulted on a scheme that would include glass. The UK government have since stipulated that glass would no longer be included, and have said they want to make sure that any Scottish scheme works in the same way as what’s being planned for the rest of the UK.

The Scottish Greens minister Lorna Slater said that this decision meant that the scheme was no longer feasible in its current form:

“These delays and dilutions lie squarely in the hands of a UK government that has sadly seemed so far more intent on sabotaging this parliament than protecting our environment.”

Some figures in the alcohol industry have been very outspoken about the scheme. The Scottish Licensed Trade Association said it would have a detrimental impact on “everyday aspects of pub life”. The Wine and Spirit Trade Association has said there is little evidence it works to reduce waste and costs too much. The Scotch Whisky Association said it supported the goals of the scheme, but that in its current form it would “hamper the efforts of businesses across the country to reduce waste and bring about a more circular economy”.

Dr Kat Jones, the director of Action to Protect Rural Scotland, which has campaigned for the scheme, said:

“This is a bleak day for anyone who cares about Scotland’s litter crisis, or indeed the global climate crisis. [It] is a victory for those in industry who have never wanted to pick up the costs of their irresponsible business model.”

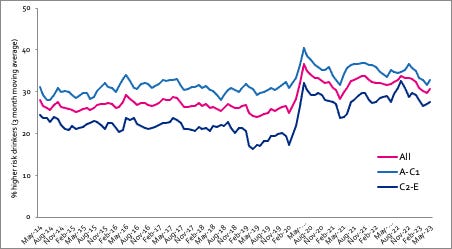

Alcohol Toolkit Study: update

The monthly data collected is from English households and began in March 2014. Each month involves a new representative sample of approximately 1,700 adults aged 16 and over.

See more data on the project website here.

Prevalence of increasing and higher risk drinking (AUDIT-C)

Increasing and higher risk drinking defined as those scoring >4 AUDIT-C. A-C1: Professional to clerical occupation C2-E: Manual occupation

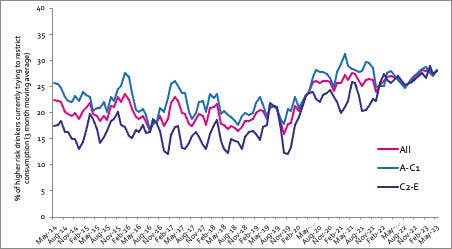

Currently trying to restrict consumption

A-C1: Professional to clerical occupation C2-E: Manual occupation; Question: Are you currently trying to restrict your alcohol consumption e.g. by drinking less, choosing lower strength alcohol or using smaller glasses? Are you currently trying to restrict your alcohol consumption e.g. by drinking less, choosing lower strength alcohol or using smaller glasses?

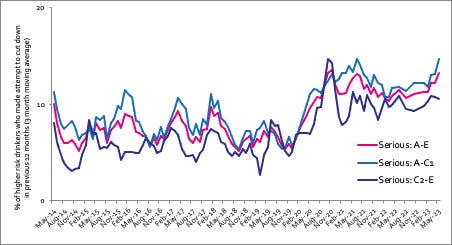

Serious past-year attempts to cut down or stop

Question 1: How many attempts to restrict your alcohol consumption have you made in the last 12 months (e.g. by drinking less, choosing lower strength alcohol or using smaller glasses)? Please include all attempts you have made in the last 12 months, whether or not they were successful, AND any attempt that you are currently making. Q2: During your most recent attempt to restrict your alcohol consumption, was it a serious attempt to cut down on your drinking permanently? A-C1: Professional to clerical occupation C2-E: Manual occupation

Podcast

Our monthly podcast features interviews with experts from across the sector.

Gambling industry harms and parallels with the alcohol world

Will Prochaska –

Coalition to End Gambling Ads