Alcohol consumption is a major global public health concern, causing various social and health harms. To address these issues, governments often impose alcohol excise taxes. However, some argue that increasing alcohol taxes leads to a decrease in government revenue. This blog post examines the relationship between alcohol taxes and government tax revenue, as well as the impact of changes in these taxes on government revenue.

The analysis considers data from Estonia, Latvia, Lithuania, Poland, and Germany. In recent years, the Baltic countries have repeatedly increased alcohol taxes, while Poland has implemented minor increases. Germany, on the other hand, has maintained stable alcohol taxes for many decades. This difference in approach to alcohol taxes provides an interesting case study.

The tax revenue varies across countries

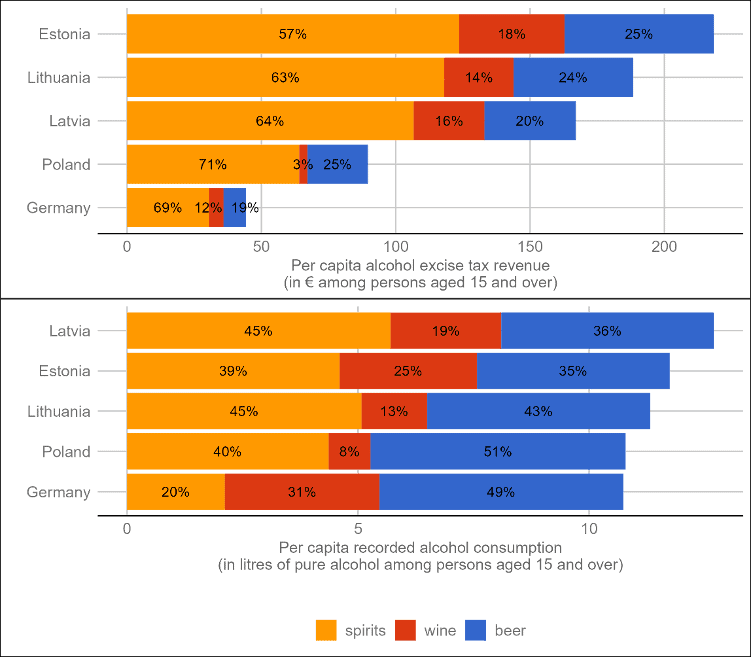

The case study shows that there are significant differences in the revenue generated by various types of alcoholic beverages in different countries. Latvia, Lithuania, and Estonia have relatively high revenue figures, while Germany and Poland lag behind.

The data from 2020-2022 indicates that alcohol consumption levels in the adult populations of these five countries are relatively similar, ranging from 10 to 13 litres of pure alcohol per adult. However, there are significant variations in the tax revenue generated, as shown in the upper half of the figure.

The high revenue figures generated in the Baltic countries are likely due to a different approach to taxing alcohol, rather than higher consumption.

Trends in Per Capita Alcohol Excise Tax Revenue

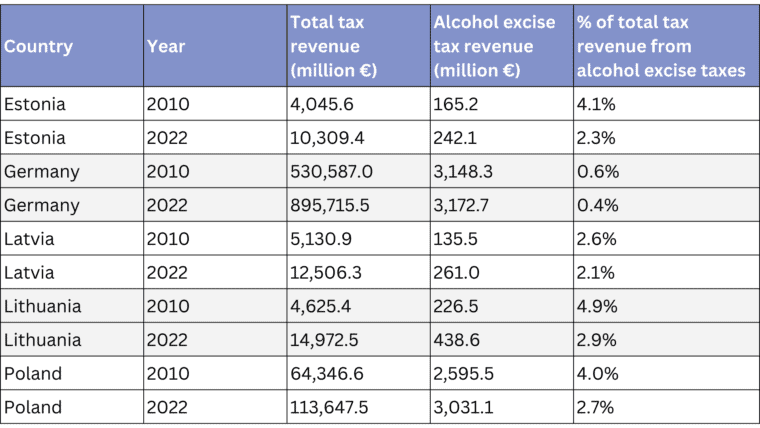

We analysed the alcohol tax revenue trends and compared them to the total tax revenue (sales tax, income tax, etc.) over time in five countries. We observed that total tax revenue has increased substantially since 2010, parallel to overall economic growth. However, the inflation-adjusted government revenue from alcohol taxes has declined in Germany, Poland, and Estonia. Only in Lithuania and Latvia, an inflation-adjusted increase in government revenue from alcohol taxes was observed. Alcohol tax revenue contributed less to the total government revenue in 2022 compared to 2010 in all five countries. The table presents the exact figures.

How Changes in Alcohol Taxation Impact on Government Revenue

The impact of changes in alcohol taxation on government revenue is analysed next and two interesting patterns are observed.

First, if no changes are made to excise taxes, there is a close correlation between sales volume and tax revenue. For example, in Germany, tax revenue declined slightly, with parallel trends in sales data.

Second, during periods of excise tax increases, the correlation between alcohol sales and government revenue diminishes or even reverses. For instance, in Lithuania, alcohol taxes have increased almost every year from 2014 to 2022. In this period, government revenue from alcohol taxes has increased by over 50%, while the volume of alcohol sales has decreased.

Conclusion

The findings of this case study highlight the significance of alcohol excise taxes for both fiscal and public health objectives. Specifically, increasing alcohol taxes can enhance revenue streams while curbing harmful consumption patterns. Thus, the results contrast industry claims according to which “taxation and other pricing policies can lead to unintended outcomes, including losses of government revenue instead of gains”.

Alcohol excise taxation is an underutilised tool to address the dual challenges of fiscal management and public health. European countries can maximize revenue streams and promote responsible alcohol consumption while mitigating associated harms by adopting evidence-based tax policies.

Policy makers engaged in protecting public health and those involved in fiscal policies should be informed of these findings. It is time to optimize alcohol excise taxation for the benefit of society as a whole.

Written by Dr Jakob Manthey, Center for Interdisciplinary Addiction Research, University Medical Center Hamburg-Eppendorf.

The study is available open access at: The Impact of Raising Alcohol Taxes on Government Tax Revenue: Insights from Five European Countries (2024), Applied Health Economics and Health Policy

All IAS Blogposts are published with the permission of the author. The views expressed are solely the author’s own and do not necessarily represent the views of the Institute of Alcohol Studies.