A new Center for Global Development (CGD) Policy Paper finds that on average the annual alcohol tax revenue collection is a quarter of the yearly cost of the productivity loss from alcohol-attributable death and disability in 25 large economies (G20 members plus Bangladesh, Nigeria, Pakistan, Ukraine, and Vietnam).

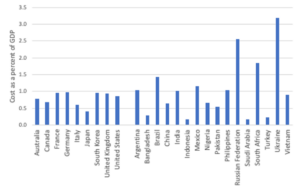

The authors show that in these countries 1.2 million people die of alcohol-attributable diseases every year. They find that the cost of productive years of life lost due to premature death from alcohol-attributable diseases and of years lived with alcohol-attributable disability amounts to US$855 billion in 2019, with the highest costs as a share of income observed in Brazil, Mexico, Philippines, Russia, South Africa, and Ukraine (Figure 1). The authors also consider the productivity losses from tobacco use and diets high in sugar-sweetened beverages.

Figure 1. Productivity Loss from Alcohol-attributable Death and Disability, 2019 (in percent of GDP)

Sources: Author’s calculations using data from Institute for Health Metrics and Evaluation Global Burden of Disease 2019, World Bank World Developments Indicators, and World Health Organization Life Tables.

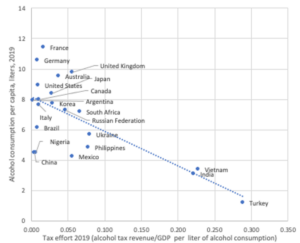

Corrective taxes on alcohol are a highly effective way to reduce or deter harmful consumption of alcohol

A review of 50 studies that examined the impact of taxes and prices on various harms caused by alcohol concluded that a 10% increase in alcohol taxes was associated with a 3.5% decline in all harms associated with alcohol-related diseases and injuries, including car crashes, homicide, rape, robbery, child abuse, and workplace injuries. The WHO also recommends raising prices on alcohol through excise taxes and pricing policies.

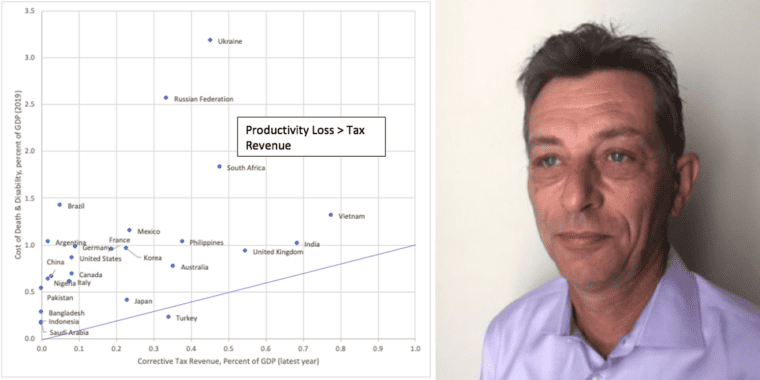

In practice, corrective taxes on alcohol are very low relative to the economic costs of death and disability in almost all countries (Figure 2). On average, taxes would need to rise by 0.7% of GDP, or quadruple current collections, to match the productivity loss from death and disability. Additional corrective taxes are warranted for medical treatment costs. Only one country, Turkey, levies corrective taxes in an amount greater than the productivity loss, reflecting large corrective tax increases in recent years that raised the price of alcoholic drinks by 1,800% between 2001 and 2020. Taxes on alcohol and tobacco account for 12 percent of total tax revenue in Turkey.

Figure 2. Alcohol: productivity loss from mortality and disability, and corrective taxes, 2019 or latest year, as a percentage of GDP

Source: WHO Global health observatory and author’s compilation of tax receipts data.

Conclusion

Almost all advanced economies and emerging markets could reap substantial macroeconomic benefits from better health by raising corrective taxes on alcohol, which currently are just a ‘drop in the ocean’. Higher corrective taxes on tobacco, and consideration of corrective taxes on added sugar, notably for sugar-sweetened beverages, could also make a significant contribution to lowering death and disability from consumption of harmful products.

Written by Chris Lane, Non-Resident Fellow, Center for Global Development

All IAS Blogposts are published with the permission of the author. The views expressed are solely the author’s own and do not necessarily represent the views of the Institute of Alcohol Studies.