Alcohol use accounts for about one in 25 cancers in the World Health Organization (WHO) European Region. To reduce the health burden of alcohol, various policy options have been proposed. Among others, increasing taxes on alcoholic beverages seem to be a promising tool to reduce alcohol consumption and its adverse health outcomes, including cancers.

In our research, we studied the impact of increased taxation rates on the number of new cancer cases and deaths in the WHO European Region.

How many new cancer cases and deaths could be prevented by increasing alcohol taxes?

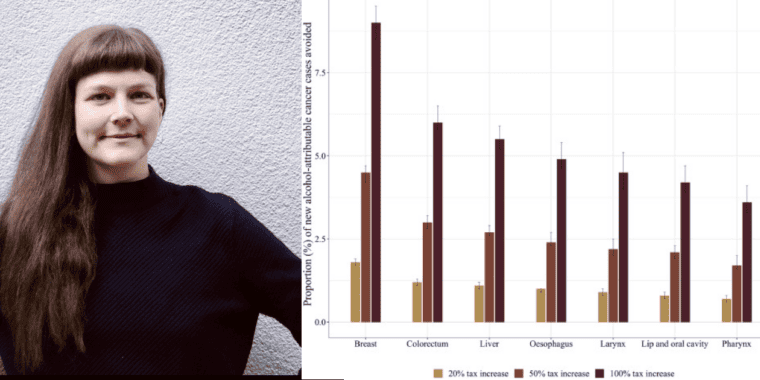

To answer this question, we estimated what would happen if current alcohol taxation rates were increased by 20%, 50% and 100% using a modelling approach.

We found that a total of 10,700 new cases and 4,850 deaths from cancers caused by alcohol could have been avoided if alcohol taxes were doubled. The largest reductions would occur in female breast cancer and colorectal cancer, with more than 3,500 avoidable new cases each.

The countries where most cancers could have been avoided are the United Kingdom (UK; 1,800 avoidable cases and 680 avoidable deaths, or about 11% of new cancer cases and deaths), Russia (1,400 avoidable cases and 725 avoidable deaths, or about 5% of new cancer cases and deaths), and Germany (1,250 avoidable cases and 525 avoidable deaths, or about 5% of new cancer cases and deaths).

What does it mean to ‘double’ current excise duties on alcoholic beverages?

In Europe, all countries levy some kind of taxation on alcoholic beverages. However, the exact rate varies between different types of alcoholic beverages and countries. As a result, the impact of increased taxation will vary from country to country.

For example, in the UK, a doubling of the current alcohol taxes would increase the retail prices for beer and wine by about 20% (i.e., by about £0.50 for a pint of beer and about £2.25 for a 25 oz bottle of wine) and spirits by about 30% (i.e., by about £5.75 for a half litre of spirits).

Across all countries studied, a doubling of excise duties would increase retail prices by an average of 14% for beer (range: 1% to 39%), 9% for wine (range: 0.1% to 38%), and 32% for spirits (range: 3% to 75%).

Which cancers are linked to alcohol consumption?

The International Agency for Research on Cancer (IARC) classifies alcohol as a so-called Group 1 carcinogen, which is the same group as tobacco smoking. Seven different types of cancer can be caused by alcohol: lip and oral cavity cancer, oesophageal cancer, pharynx cancer, larynx cancer, liver cancer, colorectal cancer and, in women, breast cancer.

Just recently, WHO and IARC have published a fact sheet covering the most important information on alcohol and cancer.

What is the impact of our research?

Our study demonstrates that excise duties on alcoholic beverages can be used to reduce a relevant number of cancers in Europe. Importantly, cancer takes time to develop, so tax increases will not immediately affect the cancer burden. However, we would benefit from this policy in the long term, and very likely see a marked decrease in the number of new cancer cases and deaths caused by alcohol over a period of ten or more years.

We hope that policy makers acknowledge the potential of this health policy that we have demonstrated in this study and that is currently underutilised in most European countries.

Written by Carolin Kilian PhD, Institute of Clinical Psychology and Psychotherapie, Technische Universität Dresden

All IAS Blogposts are published with the permission of the author. The views expressed are solely the author’s own and do not necessarily represent the views of the Institute of Alcohol Studies.